The Best Guide To Capital Gains Taxes In California

Table of ContentsThe Greatest Guide To Real Estate Investment Companies In California1031 Exchange Can Be Fun For EveryoneThe Facts About Capital Gains Taxes California RevealedExcitement About Capital Gains Taxes California1031 Exchange California - An Overview

1031 Exchanges have a really stringent timeline that requires to be adhered to, and typically require the support of a certified intermediary (QI). Check out on for the standards and timeline, and also accessibility even more info concerning updates after the 2020 tax obligation year here. Consider a story of 2 investors, one who used a 1031 exchange to reinvest earnings as a 20% down settlement for the next residential or commercial property, and an additional that utilized funding gains to do the exact same point: We are utilizing rounded numbers, omitting a great deal of variables, and presuming 20% total gratitude over each 5-year hold period for simplicity.This table also does not represent present capital created during each hold duration, which would most likely be greater when using 1031 exchanges to increase acquiring power for each and every reinvestment. After two decades, the anticipated profile worth of $1,920,000 when pursuing a 1031 exchange method compares favorably with a forecasted value of only $1,519,590 when paying funding gains tax obligations along the means.

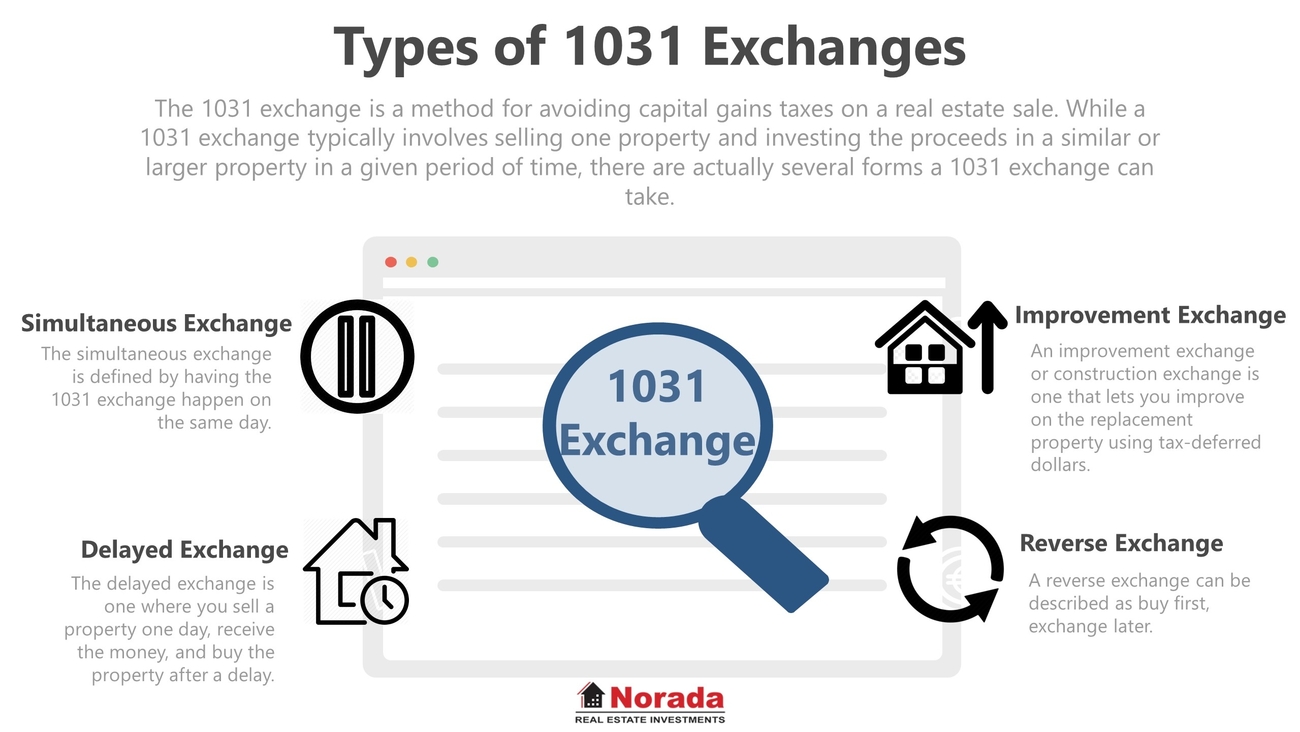

Here's guidance on what you canand can not dowith 1031 exchanges. # 3: Testimonial the 5 Typical Kinds Of 1031 Exchanges There are 5 usual sorts of 1031 exchanges that are most commonly utilized by genuine estate capitalists. These are: with one residential property being soldor relinquishedand a substitute home (or homes) bought throughout the allowed home window of time. view.

The Single Strategy To Use For 1031 Exchange California

The intermediary can not be a person that has actually worked as the exchanger's representative, such as your staff member, legal representative, accountant, lender, broker, or actual estate representative (click reference). It is best practice nonetheless to ask among these people, frequently your broker or escrow policeman, for a recommendation for a qualified intermediary for your 1031.

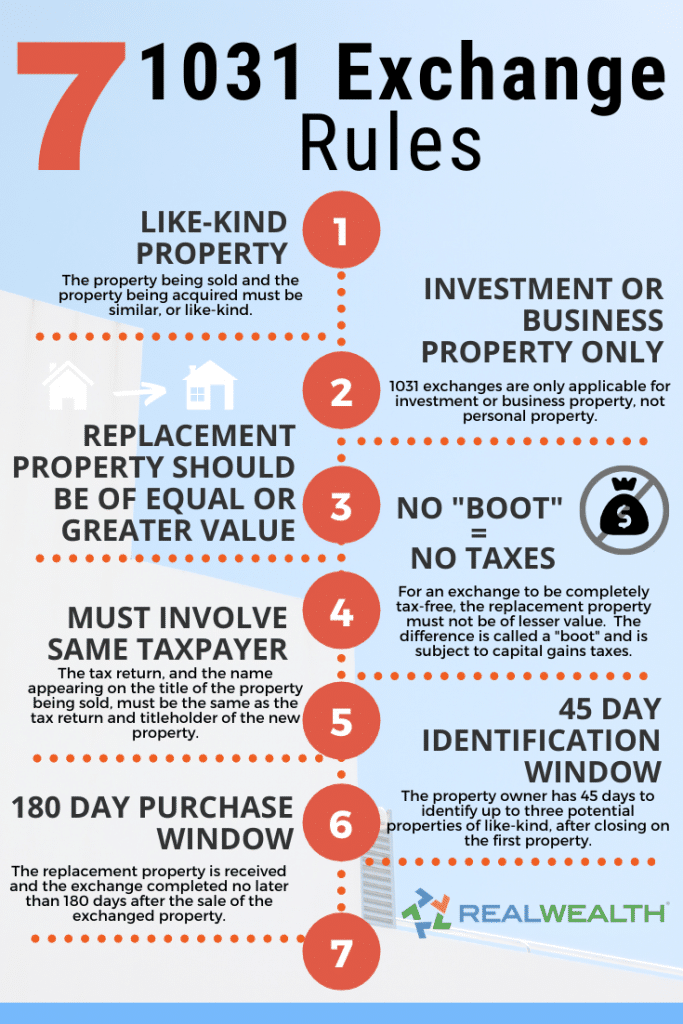

The 3 primary 1031 exchange regulations to adhere to are: Replacement residential or commercial property need to be of equal or higher worth to the one being sold Replacement home have to be recognized within 45 days Substitute home need to be purchased within 180 days Greater or equal worth replacement property rule In order to take advantage of a 1031 exchange, real estate capitalists need to identify a substitute propertyor propertiesthat are of equivalent or higher value to the residential property being marketed.

Tax Shelter Real Estate - The Facts

That's due to the fact that the IRS just allows 45 days to determine a substitute home for the one that was marketed. But in order to get the best price on a substitute property experienced real estate investors don't wait until their home has been sold before they begin seeking a replacement.

The chances of obtaining an excellent cost on the residential property are slim to none. 180-day home window to acquire substitute home The purchase and closing of the substitute building need to occur no later than 180 days from the time the existing residential or commercial property was offered. Keep in mind that 180 days is not the very same point as 6 months.

The 8-Minute Rule for 1031 Exchange Rules

To keep things basic, we'll think 5 points: The current residential or commercial property is a multifamily building with an expense basis of $1 million The marketplace value of the structure is $2 million There's no home loan on the home Charges that can be paid with exchange funds such as compensations and also escrow charges have actually been factored right into the expense basis The resources gains tax price of the residential or commercial property owner is 20% Marketing realty without using a 1031 exchange In this instance let's claim that the investor is tired of owning actual estate, has no heirs, and selects not to seek a 1031 exchange.

8% net financial investment tax obligation above income earners + any additional state funding gains taxes relying on where the property is located. In California, the state resources gains tax obligation liability can be as high as an extra 13. 3%, More hints or an additional $133,000! Marketing realty making use of a 1031 exchange Instead, we 'd make use of a 1031 tax-deferred exchange as well as adhere to these steps: Sell the present multifamily structure and send out the $1M proceeds out of escrow straight to a 1031 exchange facilitator.

5 million, and an apartment structure for $2. 5 million. real estate investment companies california. Within 180 days, you could do take any type of among the adhering to activities: Purchase the multifamily structure as a replacement residential property well worth at the very least $2 million as well as defer paying capital gains tax obligation of $200,000 Purchase the 2nd home building for $2.

The 6-Minute Rule for 1031 Exchange Rules

5 million as well as pay $100,000 in capital gains tax on the taxed gain (or boot) of $500,000 Purchase the purchasing facility with another property for a total replacement value of more than $2 million and postpone paying resources gains tax # 6: Job to Get Rid Of Capital Gains Tax obligation Completely 1031 exchanges deferor placed off to the futurethe settlement of accumulated resources gains tax obligation - additional info.

Which only mosts likely to reveal that the stating, 'Nothing makes certain other than death and also tax obligations' is only partly real! Finally: Things to Remember about 1031 Exchanges 1031 exchanges allow investor to postpone paying capital gains tax obligation when the profits from property offered are used to buy substitute realty. 1031 exchange real estate.

Rather of paying tax on funding gains, investor can place that additional money to work quickly as well as take pleasure in higher present service income while growing their portfolio much faster than would certainly or else be possible.